Cloud Technology

Cloud Technology

Cloud technology is an essential development in the computing space. Although the concept is not entirely new, the tools make it easy for developers to manage virtual data centers. It also lowers the typically high administration costs. This enables one to focus on the solutions and not on maintenance. For example, additional server resources can be added dynamically if high performance is needed at the click of a button.

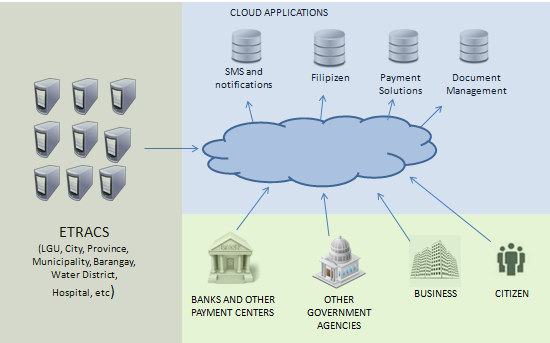

Allowing taxpayers to transact online like making payments or inquire about the status of their transactions, modernizes LGU operations. In order to do this at present, an LGU needs a huge investment in data centers and monthly leased lines plus additional human resources to develop applications and monitor transactions and security. The cost will not outweigh the benefits unless an LGU is probably big enough and their constituents technologically savvy enough like large cities. The following diagram shows the cloud topology of ETRACS.

Figure 3. Cloud Architecture

E-TRACS 2.5 was designed to be integrated with the cloud which only requires a sufficient internet connection and a small subscription fee depending on the cloud service. This is not compulsory; however, the service is available in E-TRACS should the LGU wish to avail. The advantage of this solution is that all data still resides in the server of the LGU and not on a central server. A special software enables E-TRACS to “talk” to the cloud applications that receive a request for information. If there is no connectivity, the server can send the reply later when the connection is up and running. The services below show examples of cloud solutions for E-TRACS:

- SMS (Text messaging ) capability to send notifications or receive inquiries from taxpayers through text

- Online inquiry of real property status and billing

- Online application for business

- LGU to LGU payment (applicable to province and municipalities to allow a taxpayer to pay real property from another LGU)

- Real-time approval of tax declarations (applicable for province and municipality)

- Online payment

This enables business-to-government, government-to-government, and citizen-to-government transactions to be possible. Another advantage is that LGUs do not have to worry about integration with partners, which requires tedious programming and testing because integration is only done once from the cloud. Any partner integrated into the cloud will automatically be available to all E-TRACS users. For example, when integrating with a bank, one will have to read the banks’ specifications and write code for it and do testing for acceptance. If the LGU does this by themselves, they will have to do it for every bank they want to integrate with because they have different specifications. On the other hand, if a bank is integrated with the cloud or any payment partner for that matter, this will imimagestely be available to all E-TRACS users without the LGU doing anything.

There have been many IT initiatives and huge investments made by the national government in the past and present, but because of the complexity and lack of product, having comprehensive, effective e-government is still far from being realized. E-TRACS is not only a tool to improve the collection of LGUs; it is a product with a vision. By enabling the capability to transact directly with the LGUs, ease of doing business will improve, and corruption can be lessened or perhaps, even eliminated. The E-TRACS mission is to innovate the government, one LGU at a time.